Having a good credit score is like holding a golden ticket to financial opportunities. This three-digit number plays a crucial role in many aspects of your life, from getting approved for loans to landing your dream apartment.

Think of it as your financial report card that tells lenders how well you manage your money and pay your bills.

Whether you’re planning to buy a house, finance a car, or apply for a credit card, your credit score can make or break these important life decisions.

A strong credit score not only helps you secure loans but also lets you access better interest rates, potentially saving you thousands of dollars over time. Even employers and landlords might check your credit score to evaluate your reliability.

In this guide, we’ll explain the benefits of having a good credit score and how it can open doors to better financial opportunities in your life.

What Does a Good Credit Score Indicate?

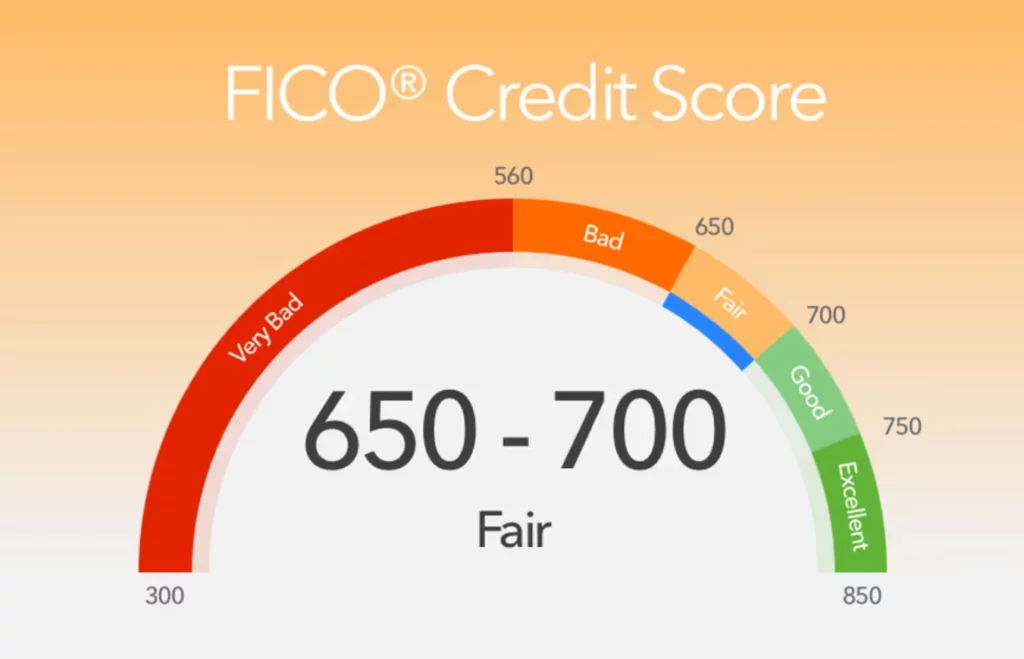

A good credit score shows how well someone handles their credit and pays his bills. In the US, credit scores typically range from 300 to 850, with scores above 670 considered good. When you have a good credit score, it tells banks and other lenders that you’re responsible with money.

Think of a credit score like a report card for your financial habits. Just as good grades show teachers, you’re studying hard, a good credit score shows lenders you’re trustworthy with money. Your credit score is calculated based on how you’ve handled credit cards, loans, and bills in the past.

A good credit score opens many doors. Lenders are more likely to approve you for credit cards and loans. They’ll also offer you better interest rates, which means you’ll pay less money over time. For example, on a $200,000 home loan, someone with a good credit score might pay hundreds less each month than someone with a poor score.

Having a good score affects more than just loans. Landlords often check credit scores before renting apartments. Many employers look at credit reports during hiring. Insurance companies might offer lower rates to people with good credit scores. Even cell phone companies check credit scores before offering their best plans.

Several factors build a good credit score. Paying bills on time is the most important – it shows lenders you’re reliable. Keeping credit card balances low compared to your credit limits also helps. Having a mix of different types of credit, like a credit card and a car loan, can boost your score too.

Also Read: What Habits Lower Your Credit Score

Also, time plays a big role in building good credit. A longer history of handling credit well leads to better scores. That’s why many financial experts suggest starting to build credit early, perhaps with a secured credit card or by becoming an authorized user on a parent’s credit card.

Maintaining a good score requires ongoing attention. Missing even one payment can hurt your credit score, and it can take months to recover. It’s smart to check your credit report regularly and fix any mistakes you find since errors can unfairly lower your score.

You can consider hiring a credit repair agency like Lyn Financial Services to get inaccurate items removed from your credit report that leads to credit score improvement.

Remember that getting a good credit score is like training for a sport – it takes time, patience, and consistent good habits. The reward is greater financial freedom and more opportunities to achieve your goals.

7 Benefits of Having a Good Credit Score

1- Get Loan on Lower Interest Rates

When you borrow money from banks or lenders, your credit score becomes your financial report card. A good credit score typically means you’ll qualify for much lower interest rates on all types of loans.

This difference can be dramatic – for example, on a $300,000 mortgage, someone with an excellent credit score might get a 6% interest rate, while someone with a poor credit score might get a rate of 8% or higher.

This 2% difference means paying an extra $400 per month, adding up to nearly $150,000 more over a 30-year mortgage term.

The same principle applies to auto loans, personal loans, and even credit cards. With an auto loan of $25,000, a better interest rate could save you thousands over the loan term.

These savings aren’t just numbers on paper – they represent real money you could use for investments, family needs, or building your emergency fund.

A good credit score also means you can borrow larger amounts when needed, giving you more flexibility in major purchases.

2- Renting an Apartment Gets Easier

Another benefit of having a good credit score is that it can completely transform your rental experience.

Landlords and property management companies rely heavily on credit scores to evaluate potential tenants, often using them as the primary screening tool.

With a good score (typically 700 or above), you’re much more likely to get approved for premium apartments in desirable locations.

You’ll also have stronger negotiating power – some landlords might be willing to lower the monthly rent or offer more flexible lease terms for tenants with excellent credit.

The financial benefits are significant too. While renters with poor credit often need to pay deposits equal to two or three months’ rent, those with good credit might only need to pay one month’s deposit.

Some landlords might even waive certain fees altogether. Additionally, having good credit means you likely won’t need a co-signer, which gives you more independence and flexibility in choosing where to live.

In big cities where rentals are competitive and more people apply for the same apartment, your good credit score could be the factor that puts your application at the top of the pile.

3- Get Better Home and Auto Insurance Rates

Insurance companies view your credit score as a predictor of risk, using special “insurance scores” based on your credit history.

With a good credit score, you could save 20-50% on your car insurance premiums. For example, if the average car insurance premium is $1,500 annually, good credit could save you $300-750 per year.

Home insurance works similarly – a good credit score might save you hundreds annually on your premiums. Beyond just saving money, good credit often gives you access to better coverage options and higher coverage limits.

Insurance companies are more likely to offer comprehensive packages with additional benefits to customers with good credit. You also might qualify for special programs like accident forgiveness or vanishing deductibles that aren’t available to those with lower credit scores.

Over time, these insurance savings can add up to thousands of dollars, providing both better protection and more money in your pocket for other needs.

4- Avail Better Credit Card Deals

A good credit score unlocks access to the most rewarding credit cards in the market. Premium credit cards often offer significant sign-up bonuses worth $500-$1,000 or more in travel rewards or cash back.

The ongoing benefits can be even more valuable – cards might offer 2-5% cash back on everyday purchases, free airport lounge access worth $500+ annually, or hotel elite status that includes room upgrades and free breakfast.

Travel cards also provide trip insurance, rental car coverage, and no foreign transaction fees, saving frequent travelers thousands per year.

Many premium credit cards also offer purchase protection, extended warranty coverage, and special access to events or concert tickets.

The interest rates on these credit cards are typically much lower too, which can save you money if you ever need to carry a balance.

While many of these credit cards have annual fees, the benefits often far outweigh the costs for people who can maximize the card’s features.

5- Land Better Jobs

Your credit score also has a major impact on your job prospects, especially in fields dealing with money or sensitive information.

Many employers view credit reports as indicators of responsibility and trustworthiness. This is particularly true for positions in banking, financial services, accounting, or any role involving fiscal responsibility.

Some government positions and jobs requiring security clearances also require good credit.

Beyond just getting hired, good credit can affect promotions and advancement opportunities. For positions that involve managing budgets or handling company finances, employers often consider credit history in their decisions.

While the Fair Credit Reporting Act requires employers to get your permission before checking your credit, having good credit can give you confidence during job searches and negotiations.

It’s one less potential obstacle in your career path and can even be a differentiating factor when competing for high-level positions.

6- No Utility Deposits

A good credit score eliminates the need for utility deposits, which can add up to hundreds of dollars when setting up new services.

Electric companies might require deposits of $100-300, and other utilities like gas, water, and internet providers might each require similar amounts.

With a good credit score, these deposits are typically waived entirely. Beyond avoiding deposits, a good credit score often qualifies you for better payment terms and billing options.

You might have more flexibility in payment due dates or qualify for budget billing programs that spread seasonal cost variations across the year.

Some utility companies offer their best rates and programs, like green energy options or premium internet speeds, to customers with a good credit score.

Over time, these benefits add up to significant savings and more convenient service options, making it easier to manage your household expenses and maintain your preferred lifestyle.

7- Get Favorable Terms on New Phone Purchase

A good credit score significantly improves your options when getting a new phone or mobile plan. Wireless carriers offer their best deals, including zero-down phone purchases and device payment plans, to customers with good credit scores.

For example, when the latest smartphone costs $1,000 or more, good credit lets you split that cost into monthly payments with no interest. You might qualify for special promotions like “buy one, get one free” phone deals that require credit approval.

Carriers also offer their unlimited data plans and family plans with better terms to customers with good credit.

Instead of paying deposits or having limited plan options, you can choose from any available plan and often get additional perks like free streaming service subscriptions or international calling features.

This flexibility and access to better deals can save hundreds of dollars when setting up new services or upgrading phones for your family.